Invest without Carbon: Greenflation, and turning costs into opportunities through ESG research

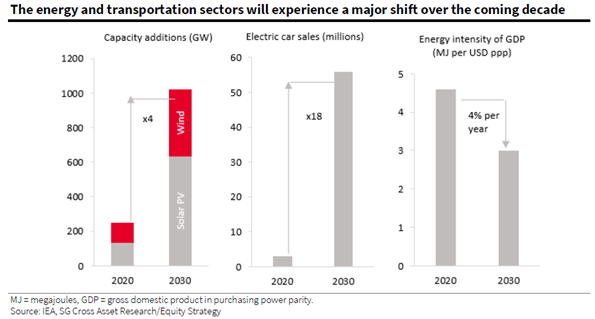

Energy transition comes at a cost, which market participants and policymakers have called “greenflation”. Greenflation is the inflation created when prices of commodities needed to green the economy rise due to increased demand or reduced supply.

Kokou Agbo-Bloua, Global Head of Economics, Cross-Asset and Quant Research at Societe Generale, earlier wrote in another article on greenflation and how inflation is supercharged by the cost of green transition.

Increasing emphasis on low-emission energy sources in Asia

As an illustration, an electrical vehicle consumes seven times1 more minerals than a conventional car. It also requires a wider range of minerals, some of which such as nickel and cobalt are not used before. At the same time, the Covid pandemic and geopolitics have disrupted global supply chains and sent major shocks in commodity markets, prompting Europe and the US to rethink their sourcing strategy.

Asia is also catching up, with a greater emphasis on low-emission sources of energy: wind and solar energy are at the centre of China’s five-year plan for energy, while Japan and Korea are expected to significantly raise the weight of nuclear power in the electricity mix.

In Southeast Asia, energy demand has increased on average by around 3%2 a year over the past two decades, and this trend continues to 2030. Policymakers across the region have also established long-term plans to achieve net-zero emissions aspiration. For example, Singapore continues to maximise its solar panel deployment and plans to also scale up its low-carbon hydrogen investment. Malaysia launched the National Energy Policy 2022 – 2040 in late 2022, which details its ambition to usher the nation towards being a low carbon nation by 2040 through multiple means such as increasing the use of renewable energy and EV share while reducing the percentage of coal in installed capacity.

However, the current supply and investment plans for many materials, as well as the technology required to change our current infrastructure, fall well short of what is needed to support our pathway to net zero. To solve these climate change issues, the world will require vast amounts of investment, innovation, and international cooperation. This presents opportunities for investors.

Tracking impact of Greenflation

Societe Generale’s Cross Asset Research team has conducted extensive research on greenflation to analyse its impacts and implications for companies and investors and has built an index which offers exposure to the theme3. The index tracks the performance of 50 stocks listed in the US, Asia and Europe that benefit from rising demand for metal and minerals and from a new mining investment cycle. It has substantially outperformed the broad market since the 2015 Paris Agreement.

Beyond the Greenflation theme, investors face increasing challenges to integrate ESG in their investment and asset allocation framework. When it comes to ESG integration, one difficulty is the lack of standardisation in sustainability reporting by corporations. To help investors navigate these challenges, SG has turned ESG research into one of its core components and embedded ESG considerations to all research departments, including critical ESG themes and issues such as hydrogen, water and waste management, gender diversity and aging populations.

For equity analysts, it means integrating material ESG metrics into stock recommendations and target prices. For cross-asset analysts, it is about providing expert advisory services, from estimating the economic costs of green transition to offering a methodology to decarbonize portfolios or building an ESG ratings consensus.

As a leading financial institution, it is important for the bank to embrace the social responsibility of educating investors about the long-term challenges we face and what we can do to meet our sustainability commitments.

1. https://www.iea.org/data-and-statistics/charts/minerals-used-in-electric-cars-compared-to-conventional-cars

2. https://www.iea.org/reports/southeast-asia-energy-outlook-2022/key-findings

3. https://insight-public.sgmarkets.com/insights/greenflation-equity-exposure

IMPORTANT NOTICE:

This website and its contents are for informational purposes only and is not a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. SG Research is for institutional and professional clients only. Visitors to this site should not take any investment decision based on the summary material provided here, which should be read in the context of the underlying research report made available to subscribers.

Unless otherwise stated, any views or opinions expressed in the presentation are solely those of the presenter(s) and may differ from the views and opinions of others at, or other departments or divisions of, Societe Generale (“SG”) and its affiliates. No part of the presenter(s) compensation was, is or will be related, directly or indirectly to the specific views expressed herein. This material is provided for information purposes only and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument. The information contained herein has been obtained from, and is based upon, sources believed to be reliable, but SG and its affiliates make no representation as to its accuracy and completeness. The views and opinions contained herein are those of the author of this material as of the date of this material and are subject to change without notice. Neither the presenter(s) nor SG has any obligation to update, modify or otherwise notify the recipient in the event any information contained herein, including any opinion or view, changes or becomes inaccurate. To the maximum extent possible at law, SG does not accept any liability whatsoever arising from the use of the material or information contained herein.

This presentation should not be construed as investment research as it has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Therefore, even if it contains a research recommendation, it should be treated as a marketing communication. This publication is not subject to any prohibition on dealing ahead of the dissemination of investment research. Notwithstanding the preceding sentence SG is required to have policies in place to manage the conflicts which may arise in the production of its research, including preventing dealing ahead of investment research.

Societe Generale named "Americas Bank of the Year" by PFI

Societe Generale has demonstrated its leadership in project and infrastructure finance, earning several recognitions...

Why ship finance will keep steaming ahead in 2026

By Pierre Carassus, Head of Maritime Industries, Asia-Pacific at Societe Generale.

Societe Generale Appoints Wei Yao as Global Chief Economist

Societe Generale is pleased to announce the appointment of Wei Yao as Global Chief Economist for its Corporate and...

Transition finance is Asia’s opportunity to show leadership

By Tessa Dann, Head of Sustainable Finance, Asia Pacific